Vol. 1, No. 2, Published June 8, 2015

Connecting the Dots: Global and National Forces Impacting California

By Lynn Reaser

Oil prices have continued to strengthen from the lows reached in the first quarter.

Global Factors

International forces continue to impact California companies and households. This year has already seen sizable swings with notable developments in China, Europe, the oil market and the dollar.

China is struggling to achieve its 7.0 percent growth target for real gross domestic product (GDP) this year, which is necessary to keep unemployment from rising. This effort comes at a time of persistent concerns over excess capacity in building and other industries and troubled loans in the banking system. At this point, China�s central bank has chosen to inject more funds into the economy and support financial institutions in order to spur economic growth. A growing Chinese economy will be positive for California exporters to the region.

Europe appears to be faring better than expected. The standoff between Greece and creditors of the Eurozone and the International Monetary Fund persists. An eventual compromise is likely as opposed to a Greek exit from the common-currency union. Meanwhile, Eurozone real GDP growth equaled 1.6 percent in the first quarter, the best showing in nearly two years. For the first time since the first half of 2010, all four of the major countries in the Eurozone -- Germany, France, Italy, and Spain -- shared in the gains. Although France and Italy have yet to make major structural reforms, Europe�s economy should continue to grow this year. This will be vital to the health of the world economy as well as that of California.

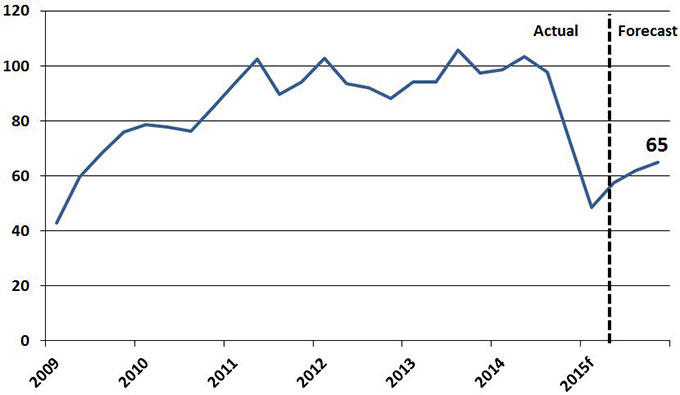

Oil prices have continued to strengthen from the lows reached in the first quarter. After peaking at around $107 a barrel in June 2014, oil prices in terms of the West Texas Intermediate (WTI) benchmark spent much of the first quarter at $50 a barrel or below. By the end of May, they had climbed to around $60 a barrel. (See Figure 22.) Companies have been cutting back oil exploration and development budgets, especially for higher cost or riskier ventures. Downward adjustments of future supply forecasts may nudge oil prices toward around $65 a barrel by year-end. Gasoline prices in California have also moved higher on stronger demand, although they should remain below their prior highs through the balance of the year.

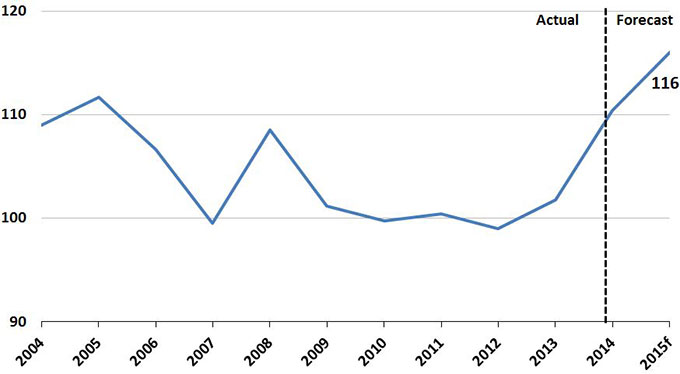

The U.S. dollar has soared much of this year as the American economy outperforms others. (See Figure 23.) The Federal Reserve appears likely to tighten monetary policy while most other central banks either ease further or maintain highly expansionary trends. Although recent softer U.S. data has brought the dollar down slightly, it is up 12 percent from a year ago versus currencies of America�s primary trading partners. The stronger dollar will make it more difficult to sell into many foreign markets, raise competition from imports and hinder foreign tourism. At the same time, a stronger dollar will benefit many California companies dependent on imports for products, parts and supplies.

National Drivers

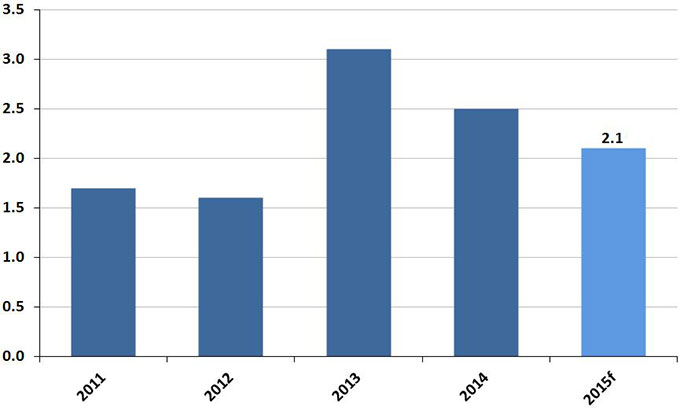

The U.S. economy began 2015 on shaky footing, with real GDP actually declining. (See Figure 24.) Spring thawing and a resumption of port activity have yet to generate a strong rebound in the overall economy. Early second quarter reports have shown lackluster retail sales and manufacturing activity. Job growth, however, is strong, the unemployment rate continues to move down and April housing starts were strong. Oil prices appear to have bottomed out and the dollar�s rise has slowed.

While real GDP growth during the second quarter could remain below an annualized 2.5 percent, growth in the second half should improve to a pace averaging 3.0 percent or somewhat higher. Households should be in a stronger financial condition, helped by pay-downs on debt and increases in stock and home prices. Commercial and home construction should bounce considerably higher. Major cutbacks in capital spending in the energy sector should ease, while firms in other industries invest more to bolster productivity. Finally, the refilling of tax coffers should promote higher government spending at state and local levels.

A resumption of faster economic growth will not be enough to totally erase the damage of the first quarter, putting growth for the total year at only around 2.1 percent. Sizable job growth should continue, pushing the unemployment rate down to around 5.0 percent or slightly below by year-end from its April level of 5.4 percent. This tightening of the job market should finally yield stronger pay raises closer to 2.5 percent in contrast to the recent more moderate trend of around 2.0 percent.

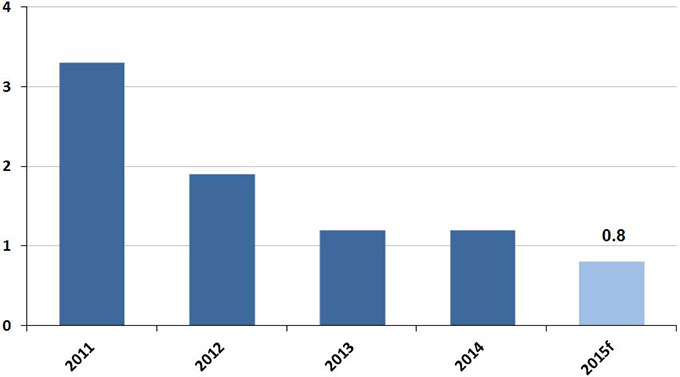

Inflation should remain benign with the Consumer Price Index ending the year up less than 1.0 percent from a year ago. (See Figure 25.) Excluding the volatile food and energy components, �core� prices are likely to be up closer to the 2.0 percent target the Federal Reserve sees as necessary for economic and financial stability. Price increases in the services sector -- including rent, health care and education -- will lead the overall rise in core inflation. Inflation should remain low, but appears likely to gradually move higher instead of moving to a state of deflation.

Overall, the nation should provide a firmer economic pull in the latter half of 2015 for California� which should add to the state�s underlying current momentum.

Figure 22: Oil Prices Recovering

WTI Crude Oil, Dollars Per Barrel, Quarterly Average

Source: The Fermanian Business & Economic Institute

Figure 23: Greenback Still in Demand

Broad Trade-Weighted Index, Jan. 1997=100, Dec. Average

Source: The Fermanian Business & Economic Institute

Figure 24: U.S. Real GDP Growth Remains Moderate

4th Quarter, Percent Change Over Prior Year

Source: The Fermanian Business & Economic Institute

Figure 25: Consumer Prices Tepid

4th Quarter, Percent Change Over Prior Year

Source: The Fermanian Business & Economic Institute

Lynn Reaser is chief of the Treasurer’s Council of Economic Advisors and chief economist at the Fermanian Business and Economic Institute for Point Loma Nazarene University. The opinions in this article are presented in the spirit of spurring discussion and reflect those of the author and not necessarily the Treasurer, his office or the State of California.