Vol. 1, No. 5, Published September 9, 2015

Guest Column

Are High Housing Prices California�s Achilles Heel?

By Gerd-Ulf Krueger

It is a foregone conclusion that California has some of the highest housing costs in the nation. According to the California Association of Realtors, which publishes an income distribution based affordability index, just 30 percent of California households could afford the state�s median priced home in the second quarter of 2015. That represents a dismal 27 percentage point gap compared to the nation�s affordability rate of 57 percent.

There has been some discussion in the media lately about whether high home prices could become the Achilles heel of California�s economy. This is unlikely to be the case -- at least not in a cyclical sense. However, it could heighten other risks of an economic and socio-economic nature.

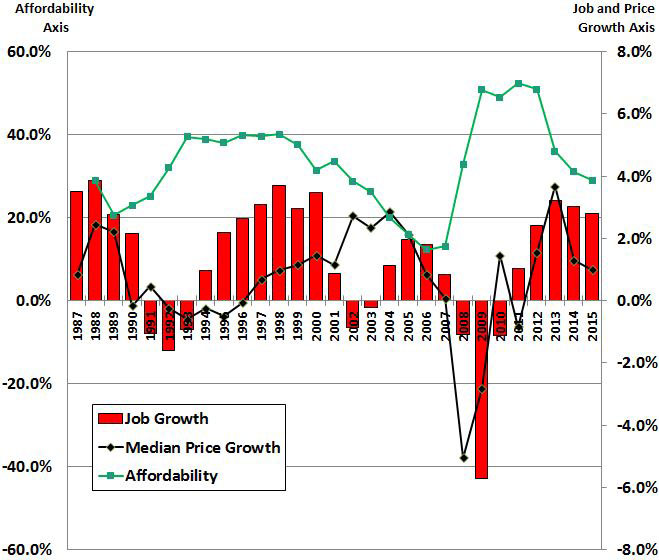

Figure 22, which plots California�s housing affordability versus job and home price growth since 1987, does not show that low affordability and high home prices cause a recession. Sure, low housing affordability roughly precedes economic downturns, but in the 1991 to 1993 downturn the state�s recession was caused by the aerospace and military spending slump. In the 2008 to 2010 time period, the impacts of massive financial crisis resulted in the Great Recession.

If anything, rather than high home prices being the Achilles heel of the California economy, it tends to be the other way around. The economy is the Achilles Heel of home prices, which declined in the 1990 to 1996 period and cratered sharply during the Great Recession. As prices dropped during those times in California, affordability sharply improved -- assisted by downward trends in mortgage rates. Ironically, the events that improve housing affordability the most in California are the recessions.

That puts a little bit of a damper on housing policy initiatives, which in the recent most 20 years have focused on the demand side such as subsidies for low-income households, housing finance programs, and inclusionary zoning. It is hard to determine whether these programs actually influenced the overall affordability rate as whole.

The real problem is the ecosystem in the California housing supply complex. For years, economists have argued that California housing is chronically undersupplied. Its regulatory climate and development and permitting processes are largely responsible for curbing new home supply, which in good economic times drives up the cost of housing in California relative to the nation.

If nothing gets done structurally to improve the supply of housing, the following list describes the dangers of low housing affordability, which increase economic and housing risks even when the economy is improving.

- For example, a study of United Way has recently shown that one in three California households (31 percent) do not have sufficient income to meet their basic cost of living. This is nearly three times the number officially considered to be poor according to the federal poverty level. Struggling households spend more than half of their income on housing. Furthermore, housing conditions in many California neighborhoods are getting increasingly “cramped” by having more than one person per room. California’s lower-income households are disproportionally impacted by low housing affordability.

- The economic risks are that high housing costs could put a limit on growth, impairing what it could have been otherwise. It would be interesting to see an economic impact study in this regard.

- Furthermore, the housing supply constraints aggravate the volatility of California home prices and make it bubble prone. In good times, they rise fast, only to crash in bad times, which could have ripple effects on households, causing residents to lose equity and possibly even their homes, as was the case during the Great Recession.

- Finally, low housing affordability can trigger an intensification of net domestic out-migration and, depending on the composition of those who move out versus those who move in, the state could lose talented people to other states with equally tech-oriented concentrations. For example, in Austin, Texas, a talented software engineer can easily buy a nice new home for around $400,000 in north Austin, where its high-tech jobs are concentrated. This price point is not available in California’s high-tech cities.

In conclusion, while high housing costs are not necessarily the Achilles heel of the California economy, it can have some aggravating economic and socio-economic impacts even during good times. It would be advantageous to contemplate supply-side policies in this context, such as reforming the California Environmental Quality Act (CEQA), and lowering impact fees, which often drive up new home prices by as much as one-third depending on location. Finally, since housing supply shortages are acute in urban areas, it might be useful to create a network of smart-growth-minded cities in order to share information about how to increase housing supply and therefore promote affordability. We clearly must change the structure of the California housing supply system to have a real impact on its housing affordability problem and the economic and socio-economic risks associated with it.

Gerd-Ulf Krueger, a member of Treasurer John Chiang’s Council of Economic Advisors, is principal economist and founder of KruegerEconomics, a housing and economic advisory firm for institutional investors, developers, builders, and state and local governments. The opinions in this article are presented in the spirit of spurring discussion and reflect those of the author and not necessarily the Treasurer, his office or the State of California.

Figure 22: California Housing Affordability Vs. Job and Median Home Price Growth