Millennials� Impact on the Current Housing Market Recovery: Short-Term Phenomenon or Long-Term Structural Shift?

By Joseph Janczyk, President, Empire Economics

Strong employment growth and favorable mortgage conditions have resulted in the aggregate level of new residential construction activity approaching its long-term average. However, the housing preferences of millennials have created a surging demand for apartments in urbanized areas which has offset the typical traditional demand for single-family homes in suburban/rural areas. Is this recent pattern a short-term phenomenon or a long-term structural shift?

Current Strong Core Factors Reflect a �Typical� Housing Market Recovery

Favorable employment growth, the fundamental driver of housing demand, along with low mortgage rates, has resulted in the total level of new housing units approaching its prior long-term averages, for both the Southern California and the San Francisco Bay Area Metropolitan areas. For instance, in Southern California, the total level of new housing units (including single-family detached and attached as well as apartment rentals) rose from about 18,000 in 2010 to about 53,000 in 2015, close to its long-term average of 56,000.

When these strong fundamentals were present in housing market recoveries over the past 30+ years, the recovery exhibited a similar geographical pattern: As housing prices increased in the urbanized areas, many households employed in urbanized areas often sought moderately priced single-family homes in the suburban/rural areas.

Key Extraordinary Factor: Millennials� Preferences and Needs

However, the current housing market recovery is different from a traditional recovery due to complex economic, financial and cultural factors; among these, millennials' (ages ~18-34) preferences and needs appear to be a significant factor. Millennials have continued to reside in urbanized areas in apartment rentals, rather than seeking homeownership in suburban/rural areas. Some of the factors underlying their decisions are as follows:

- Witnessed adverse impacts of the 2005-2007 housing bubble on their Generation X (ages ~35-54) parents

- Appear to delay marriage and starting families

- Attracted to apartment rental living factors:

- Near community and urban activities

- No yardwork or maintenance

- Resort-like luxury amenity packages in newer apartment complexes

- Proximity to urban employment centers with copious employment opportunities enables job flexibility

- Significant student debt hinders ability to save for a down payment or qualify for a mortgage

Resulting Increased Demand for Apartments and Market Impact

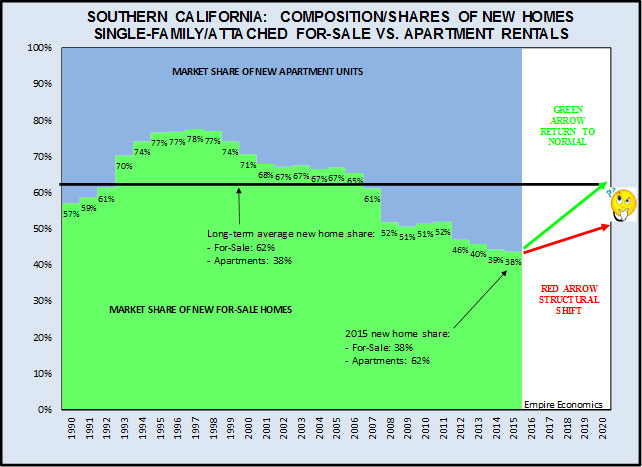

The combined impact of these social and economic factors has recently resulted in a dramatic shift toward more apartments and fewer for-sale homes. For example, in Southern California, the long-term average market shares are 62% for single-family/attached for-sale homes and 38% for apartment rentals. However, this has significantly changed during the past four years: for 2015, the share for apartment rentals amounted to 62% while single-family�s share amounted to only 38%; this represents a complete reversal of recent patterns!

This product shift has significantly impacted geographical development patterns between the urbanized and suburban/rural areas for the Southern California and San Francisco metropolitan areas. For instance, in Southern California, new apartment units in urbanized/coastal areas reached a new peak level of more than 30,000 in 2015 while new for-sale family homes in the urbanized area amounted to only about 12,500. With regards to the suburban/rural inland areas, the housing recovery has been sluggish/minimal, both for new for-sale homes as well as new apartment rentals.

Short-Term Phenomenon or Long-Term Structural Shift?

Whether the recent shift toward more apartments in urbanized areas and fewer for-sale single-family homes in the suburban/rural areas will continue during the foreseeable future depends upon a complex set of factors which are difficult to forecast, due to their cultural aspects. Specifically, of significant interest is when millennials start their families, whether they will be comfortable raising their children in high density housing in an urbanized area or instead follow the traditional pattern of purchasing single-family homes in suburban/rural areas.

In an attempt to monitor whether this recent emerging trend is a short-term phenomenon or a long-term structural shift, a metric that can be utilized is how the market for single-family homes in the suburban and rural areas changes over time with regards to housing prices. Recently, new home prices increased by about 6% in urbanized areas but only a minimal 1% in suburban/rural areas. Future changes in the relative rates of housing price changes in the various geographic areas will provide critical insights as to whether the impact of millennials is a short-term phenomenon or a long-term structural shift.

Dr. Joseph Janczyk, a member of Treasurer John Chiang�s Council of Economic Advisors, is president of Empire Economics. The opinions in this article are presented in the spirit of spurring discussion and reflect those of the author and not necessarily the treasurer, his office or the State of California.