California and Brexit: Assessing the Damage

By Lynn Reaser

The decision of British voters to leave the European Union (EU) caught markets widely off guard throughout the world as the final votes came in on June 23. The surprise move launched a massive shift to �safe haven� assets, pummeling stocks and European currencies, but boosting U.S. government bonds, the dollar, the yen, and gold.

While too early to know the ultimate outcome, markets clearly overreacted. The United Kingdom�s economy will not collapse, banks will not fail, and there will be no financial crisis. In contrast to the events surrounding the failure of Lehman Brothers in 2008, markets did not freeze and liquidity was maintained even in the immediate aftermath of the surprise vote. In fact, stocks have been quick to reverse their Brexit-related declines.

What Happens Next?

The U.K. will not immediately leave the EU. Although the British people have expressed their will to leave the EU, Parliament must first approve Article 50 that allows any member to withdraw from the EU. This is the measure contained in the Lisbon Treaty, which was signed in 2007 to guide various aspects of the current EU. Prime Minister David Cameron, who has announced his resignation, believes that a new leader should be chosen before Article 50, triggering the exit process, is launched.

The 27 countries who are still EU members will determine the terms of Britain�s exit, which must be completed in two years. Another seven or more years will then be required as the U.K. either negotiates with the EU as a whole or negotiates with individual countries. The U.K. will also have to renegotiate trade agreements with the 34 nations that have reached free trade agreements with the EU as a whole. This can be done, but it will take time.

In addition to questions regarding trade agreements, major issues now stand regarding the status of people who were previously allowed to move seamlessly across the borders of Europe, including the United Kingdom. What will be the status, for example, of the 3.2 million immigrants from the rest of the EU as well as implications for the British citizens who have now moved to other EU countries?

There is also a risk involving the integrity of the U.K. as a political entity. The independence movement in Scotland sees a new opportunity, as Scotland, along with Northern Ireland, voted to stay in the EU. Great Britain could ultimately splinter, leaving a smaller Great Britain to ply its own way forward.

Impact on the British Economy

The U.K. economy will receive a boost to its exports following the drop in the British pound to 30-year lows. However, the damage to consumer spending, investment, and construction could push the overall economy into at least a mild recession in the near-term.

Consumer confidence will be hurt, especially considering that nearly half (48%) of voters opted to remain in the EU. These individuals represent a primary source of buying power, representing younger and wealthier segments of the population. Consumer buying power will be reduced as retail goods rely heavily on imports that will now be much more expensive.

Companies will defer investment until new trade relationships are established, which will likely require considerable time. London�s position as a financial and business capital will be seriously challenged as Britain loses its favored position as a �gateway� to Europe. Most importantly, the U.K. will lose its rights of �passporting,� that allow banks and financial institutions to conduct business with clients anywhere in Europe. Great Britain features more attractive corporate tax rates than found in many other countries. For example, the U.K. features a tax rate of 20% versus the 30% rate of Germany or the 33% rate of France. The cheaper pound could also bring in new investors. However, Ireland, with its English-speaking population and a tax rate of just 12.5%, will now try to lure business away from London and the rest of the U.K. Paris and Frankfurt could also try to gain some of London’s financial activity.

Questions about business location decisions will hurt nonresidential investment, while uncertainty on the part of consumers will hurt housing.

A second referendum to reverse Brexit is unlikely, but the U.K. will work through the myriad of new economic relationships and could benefit from a reduction in some of the bureaucratic hurdles that hobble other countries in Europe. The weaker pound will give it a boost in export markets and the Bank of England will provide monetary support. Hopefully, the European Union will reexamine its current policies and take the opportunity to implement reforms to safeguard the unity of the rest of Europe.

The California Connection

What will be the impact on California? It is important to understand our linkages. In terms of economic size, California and the U.K. are similar. In 2015, California�s Gross State Product (GSP) equaled $2.5 trillion, not far shy of the U.K.'s $2.8 trillion Gross Domestic Product (GDP).

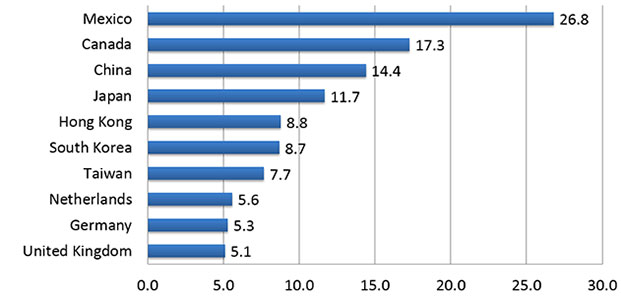

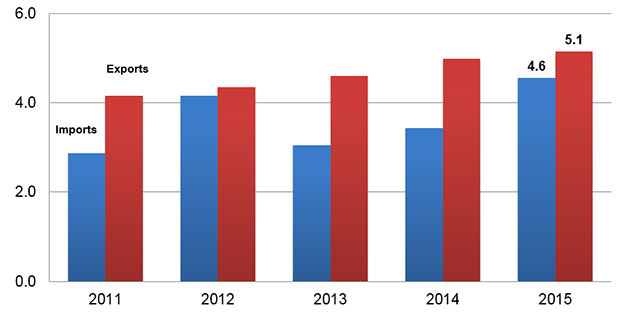

The U.K. is California�s tenth most important export market, receiving various products produced in the state equal to $5.1 billion last year. The value of goods imported from the U.K. into California reached $4.6 billion in 2015. Both exports and imports between California and Great Britain have continued to expand since the recession. (See Figures 1 and 2.)

Figure 1: U.K. is California�s Tenth Largest Export Market

Billions of dollars, 2015

Source: WISERTrade; FBEI

The other major negative ripple effects of Brexit will be the weakening of some other currencies, such as the Mexico peso, as investors have again moved away from emerging market countries viewed as higher risk. The impact of a stronger dollar will have some dampening impact on tourism and investment from those nations experiencing lower currencies.Figure 2: California Exports and Imports to U.K. Expand

Billions of dollars

Source: WISERTrade; FBEI

In terms of tourism, the U.K. is the fourth most important source of visitors to California, falling only behind travelers from Mexico, Canada, and China. With respect to dollars spent, the British rank seventh in their impact on California tourism.

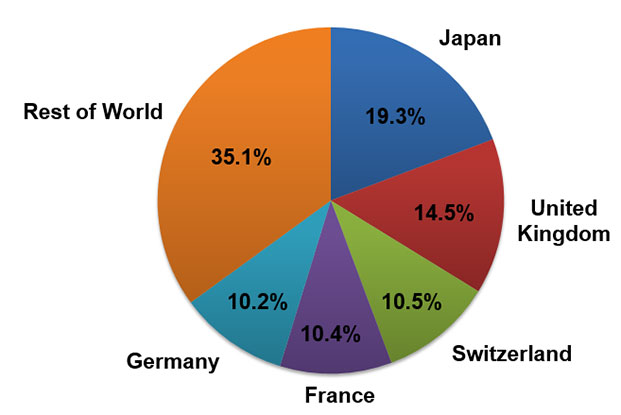

The U.K. is the second most important direct investor in California as measured in terms of employment in firms where foreign entities hold a 10% or greater ownership. The U.K. is second only to Japan in terms of direct investment in the state. (See Figure 3.)

Figure 3: U.K. Second Largest Direct Investor in California

Foreign-Owned-enterprise employment, 2013

Source: U.S. Bureau of Economic Analysis; FBEI

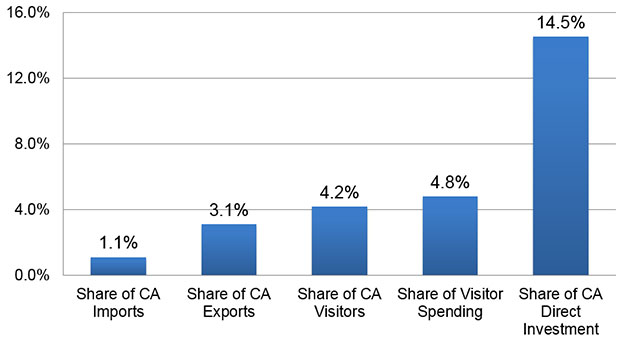

California�s exports to the U.K. and tourism from Britain will be adversely affected by a weaker British currency, but the impact will not be devastating. U.K. exports are only 3% of California�s total and U.K. tourism in terms of either numbers or dollars is 5% or less of the totals. (See Figure 4.) Direct investment could be hurt to the extent that profitability of British institutions is damaged, but the impact on California entities should be limited.

Figure 4: United Kingdom, A Major Player in California�s Economy

Percent shares

Source: U.S. Bureau of Economic Analysis; U.S. Department of Commerce; WISERTrade; FBEI

There could be some positive spillover effects. The increase in global economic uncertainty could further delay actions by the Federal Reserve to raise interest rates. The sharp drop in long-term interest rates, including mortgage rates, could also be positive for the state�s housing market. California�s borrowing costs could be reduced along with those of other safer federal and municipal agencies. On the investment side, California is well positioned because of its concentration in liquid, U.S. government securities, which the British vote has put in high demand. This will raise the prices of current assets although yields on the future investments could be low.

Lynn Reaser is chair of the treasurer’s Council of Economic Advisors and chief economist at the Fermanian Business and Economic Institute for Point Loma Nazarene University. The opinions in this article are presented in the spirit of spurring discussion and reflect those of the author and not necessarily the treasurer, his office or the State of California.