Vol. 1, No. 3, Published July 6, 2015

The CalCheck Report: Update on California’s Economic Health

By Lynn Reaser

California's economy continues to move forward, supported by a broad-based recovery. Ongoing advances in leisure and hospitality along with health care remain supportive, while a rebound in housing and construction and a surge in technology and innovation are providing a special thrust.

California scored another strong jobs report in May, with nonfarm employers adding more than 54,000 workers to their payrolls. This brought the gain for the first five months of this year to 193,000 jobs, nearly matching the robust 199,000 job advance achieved during the first five months of 2014.

Job gains continued to be spread across a wide range of industries. Compared with a year ago, some of the most impressive percentage gains have occurred in construction, transportation and warehousing, motion picture and video production, outpatient health care facilities, restaurants, and business and professional services of various types. California's boom in technology has fostered particularly impressive job increases in such areas as engineering, web design, computer systems, scientific research, and technical consulting. These typically are high-paying jobs.

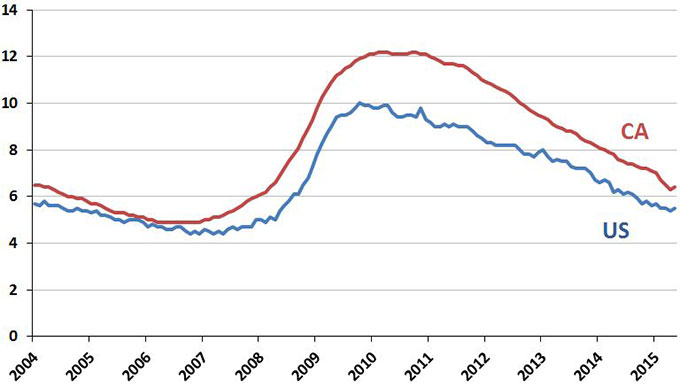

California's jobless rate did edge higher from 6.3 percent to 6.4 percent between April and May. However, this reflected a surge in the labor force, which was slightly larger than the accompanying large advance in jobs. The nation saw a similar rise in its jobless rate in May to 5.5 percent from 5.4 percent. (See Figure 16.)

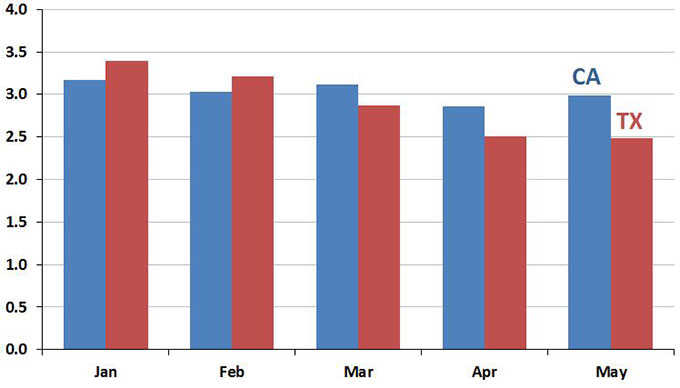

In terms of year-over-year payroll job growth, California surpassed the nation for the 39th consecutive month with a rise of 3.0 percent versus 2.2 percent. With respect to one of its primary state rivals, Texas did see a pickup in its job performance after being weighed down by lower oil prices in recent months. However, California's year-over-year job gain outpaced the Lone Star State�s rise for a third consecutive month at 3.0 percent versus 2.5 percent. (See Figure 17.)

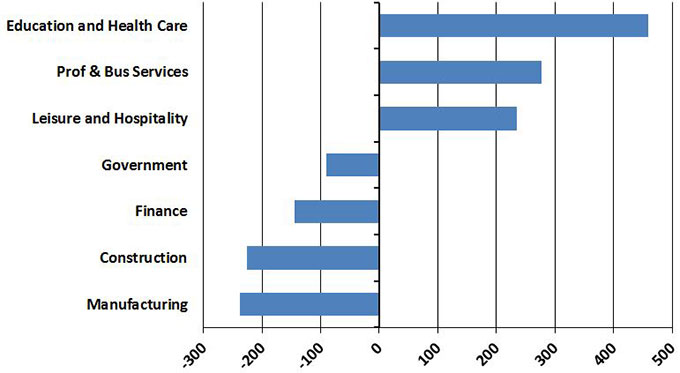

Some of California�s key sectors have surpassed their pre-Recession highs by a wide margin, while others have not yet caught up. (See Figure 18.) The manufacturing and construction sectors are still more than 200,000 jobs off their prior highs, while government and financial services jobs are down by nearly 100,000 jobs or more. In stark contrast, employment in health care and private education is higher by more than 450,000 jobs. Staffing levels in professional business services as well as leisure and hospitality are also up by between 200,000 and 300,000.

California�s housing market continues to heal, with sales of existing single-family homes reaching an annualized pace of more than 400,000 for the second month in a row during May. Tight inventories are no doubt preventing sales from reaching even higher levels. The median price of an existing single-family home rose by a moderate 4.4 percent from a year ago in May, but a wide disparity in price performance was evident. The Bay Area continued to see double-digit gains, which is starting to weigh on sales. More moderate increases are transpiring in Southern California, where sales are recording healthy gains. Various parts of the Central Valley are experiencing sizable advances in both prices and sales.

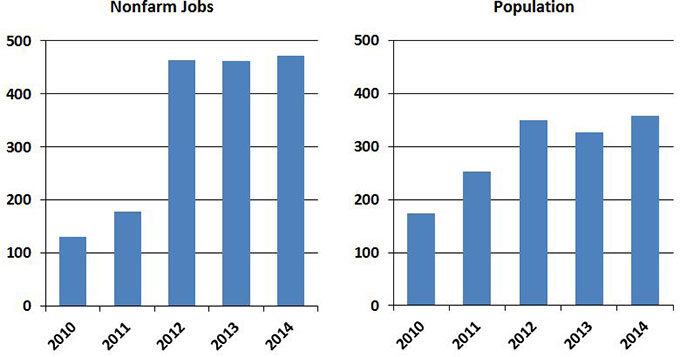

California�s economic recovery has revived its population growth, which had stalled during the Recession. (See Figure 19.) The state added 358,000 residents to its population last year, representing a growth rate of 0.9 percent. Most counties and cities shared in the gains. Although probably all of the state�s net gain in population came from natural increase (births minus deaths) and foreign immigration, the rate of net domestic out-migration (to other states) appears to have slowed.

California�s economy should continue to move ahead during the summer. The state�s drought will weigh on its agriculture business, while the state�s water restrictions will cause consumers and businesses to adjust their spending patterns and activities. The lower level of oil prices will keep a lid on oil and gas exploration. Although hospitals and other health care providers could see profit margins squeezed by lower reimbursement rates, the expansion in health care coverage will boost the demand for health care services. Tourism is also poised to see a strong summer, boosted by national gains in employment and real incomes.

The resuscitation of the housing sector will feed a wide range of businesses, ranging from architecture to home furnishings, while lower vacancy rates in office, retail, and industrial space are beginning to support more building on the nonresidential side. California�s competitive edge in technology and innovation continues to be evident, with new ideas spanning biotech, transportation, financial transactions, information, communication, transportation, and entertainment continuously on the rise.

Lynn Reaser is chief of the Treasurer’s Council of Economic Advisors and chief economist at the Fermanian Business and Economic Institute for Point Loma Nazarene University. The opinions in this article are presented in the spirit of spurring discussion and reflect those of the author and not necessarily the Treasurer, his office or the State of California.

Figure 16: California’s Unemployment Rate Trends Lower

Percent, Seasonally Adjusted

Source: U.S. Bureau of Labor Statistics, California Employment Development Department, Labor Market Information

Figure 17: California Surpasses Texas in Job Growth

Percent Change Over Prior Year

Source: U.S. Bureau of Labor Statistics, Fermanian Business and Economic Institute (FBEI)

Figure 18: Leaders and Laggards from Recession

Change From Pre-Recession Peak, Seasonally Adjusted, Thousands

Source: California Employment Development Dept., Labor Market Information; FBEI

Figure 19: Better Job Outlook Boosts Population Growth

Change Over Prior Year, Thousands

Source: California Dept. of Finance, Demographic Research Center; Haver Analytics; FBEI