CDIAC has established this page to consolidate our resources on climate topics that relate to municipal debt and public funds investment in one place. Follow the links below to jump to topics featured on this page:

- Labeled Debt (Green, Social Impact and Sustainability)

- Socially Responsible Investing

- Climate Change Disclosure in the Municipal Market

Labeled Debt (Green, Social Impact and Sustainability)

2023 Webinar | Municipal Green Bond Disclosure: Investor Guidance and Issuer Perspective

Webinar Page: Includes Replay, Slides, and Other Material

The requirement of public agency issuers to inform investors through reliable and thorough disclosure is central to a well-functioning municipal market. However, with the continued growth of labeled debt over the last decade – particularly green bonds – issuers may not be familiar with the specific investor expectations for green bond disclosure. In May 2023, the California Green Bond Market Development Committee released a paper, Recommended Approach to Municipal Green Bond Disclosure, to provide insight on investors’ expectations. This webinar will explore the recommendations contained in the paper and facilitate a discussion between investors that participated in the development of the report as well as issuers of green bonds.

August-October 2018 Webinars | Green Bonds in the Golden State: A Practical Path For Issuers

Webinar Page: Includes Replay, Slides, and Other Material

The market demand for investment opportunities that advance environmental and socially responsible goals has grown dramatically. Increasingly aware of the growing market, elected leaders and their constituents across the country have begun to demand policy that matches the climate friendly attributes of infrastructure projects with complementary financing structures. Resultantly, green bonds have emerged in the past few years as a viable financing strategy for issuers investing in low-carbon and environmentally friendly infrastructure. This three-part webinar series, which has been designed to provide public finance officials with the practical guidance needed to meet the green financing demands of their constituency. Participants will gain a clearer understanding of the risks and benefits of a green bond issuance and how to strike the proper balance between financial and environmental stewardship.

Socially Responsible Investing

December 10, 2019 Webinar | Socially Responsible Investing: Integration into the Local Agency Portfolio

Replay | Slides | Transcript

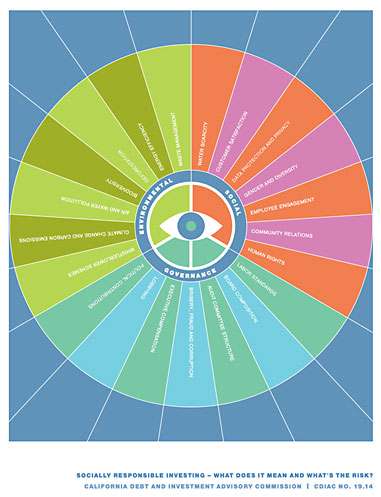

The board members and constituents of local agencies are increasingly asking that the investment of public funds take into account socially responsible investing (SRI) objectives. SRI and environmental, social, and governance (ESG) considerations may affect a local agency’s investment policy, credit analysis and investment portfolio decision process. This webinar aims to equip local investment officers with tools to help them carefully navigate the exploration and potential adoption of SRI strategies and ESG criteria. Participants will gain a better understanding of fundamental SRI and ESG concepts from CDIAC’s publication, Socially Responsible Investing – What Does It Mean and What’s the Risk?, hear how other California local agencies are integrating SRI objectives and ESG criteria, and learn about available resources that can help with SRI analysis.

2019 Publication | Socially Responsible Investing – What Does It Mean and What's the Risk?

Climate Change Disclosure in the Municipal Market

October 26, 2020 Webinars | Informing the Investment Decision: Climate Change Disclosure In the Municipal Market

Webinar Page: Includes Replay, Slides, and Other Material

The municipal market has the expectation that issuers will give investors the information they need to make prudent investment decisions. Recent events and market volatility have accelerated the demand for issuer disclosure on how external impacts, such as climate change, can translate to investment risk as well as how issuers are mitigating these risks. Issuers are faced with reconciling how to account for and incorporate these risks in their financial disclosures. This dilemma is exacerbated by the unprecedented and dynamic nature of this topic, as it makes it difficult to discern what information is accurate, relevant, and “material” for the investor. This two-part series will discuss investor expectations for climate change disclosure and how issuers are contending with these expectations.

2020 Publication | Climate Change Disclosure Among California Enterprise Issuers