California Job Tracker

By Lynn Reaser

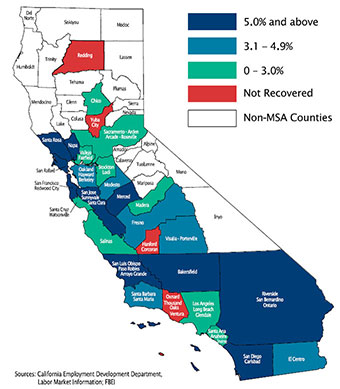

Ten Metro Areas on Expansion's Fast Track

Percent Change in Jobs from Pre-Recession Peaks

California�s job market made further progress in March with gains in employment and another drop in the jobless rate. The number of the state�s 29 metropolitan areas that had fully recovered from their recession job lows remained at 25. The number of those areas achieving advances of 5% or more from their prior employment peaks widened from eight to 10. The only four metropolitan statistical areas (MSA) that have not recovered are Hanford-Corcoran, Redding, Oxnard-Ventura-Thousand Oaks, and Yuba City.

The state�s unemployment gap relative to the country continued to shrink. Although more people entered the workforce in March, hiring was sufficient to push the unemployment rate down from 5.5% in February to 5.4% in March. As a result, the jobless rate gap over the national rate narrowed to just 0.4 percentage points at the end of the first quarter from 1.1 percentage points a year earlier.

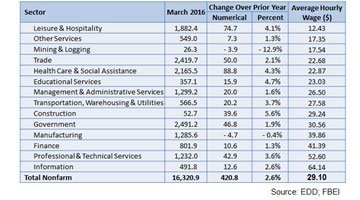

Job gains are taking place across a broad array of industries and sectors. While California only gained 4,200 jobs in March compared with the prior month, this followed a surge of nearly 47,000 new jobs in February. The year-over-year performance removes some of this volatility and showed gains in every major sector except for manufacturing, logging, and mining, with that combined loss equal to only about 2% of the state�s net job gain. (See Figure 1.)

Figure 1: California Job Growth Widespread Among Sectors

March 2016, seasonally adjusted, thousands

Health care accounted for the largest numerical change relative to a year ago, with a gain of nearly 90,000 employees. The Affordable Care Act is clearly adding to the demand for medical services. Private educational services represented the highest percentage gain with a 4.7% advance relative to the prior year.

California�s good news on the jobs front and outperformance relative to the nation represent an important vote of confidence on the part of employers. These results will also further bolster the state�s financial and economic health.

What types of jobs?

Many are concerned that the jobs we are creating are part-time and low paying. But what do the numbers show?

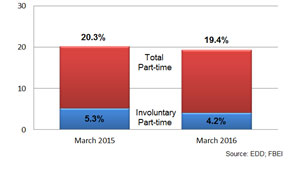

As of March 2016, 19.4% of employed individuals held part-time jobs compared with 20.3% a year ago. Significantly, most of these individuals preferred part-time work. Only 4.2% of those with jobs were working part-time because they could not find full-time work. A year ago, this number was 5.3%. (See Figure 2.)

Figure 2: Part-time Employment Drops

Share of total employment

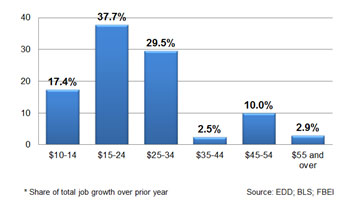

Job growth is also occurring across a broad array of wage and salary levels. (See Figure 3.) About 17% of the job gains that have taken place over the past year have been entry-level or jobs paying an average of about $12 an hour. These are primarily in leisure and hospitality. The largest share, at 38%, of job growth has taken place in the next highest tier, with most of the jobs earning around $23 an hour. These jobs are in health care, private education, and trade.

Figure 3: Job Growth Dispersed Across Wage Levels

March 2016

Another 30% of the job growth has been in the $25-34 an hour bracket, representing management and administrative services, transportation, warehousing, and utilities, construction, and government.

The fourth wage tier, $35-44 an hour, has accounted for less than 3% of the total job gain and has been concentrated in financial services.

The fifth wage tier, $45-54 an hour, has encompassed 10% of the job growth, with those positions largely in professional and technical services. The highest tier, also accounting for only about 3% of job growth over the past twelve months, has occurred in information services, ranging from software publishing to motion pictures and broadcasting. The average hourly wage in this sector is about $64 an hour.

California�s job growth has thus been not only significant in its magnitude but also in its scope and diversity, encompassing different geographies, sectors, and income levels.

See raw data: Employment numbers by region.

Lynn Reaser is chair of the treasurer’s Council of Economic Advisors and chief economist at the Fermanian Business and Economic Institute for Point Loma Nazarene University. The opinions in this article are presented in the spirit of spurring discussion and reflect those of the author and not necessarily the treasurer, his office or the State of California.