California Job Tracker

By Lynn Reaser

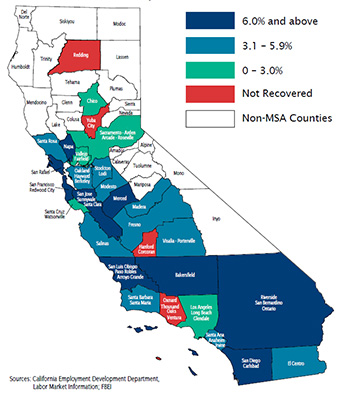

Figure 1: More Areas Move Upward

Percent Change in Jobs from Pre-Recession Peaks

Continued Momentum

California�s job market remained healthy in June, with job gains widespread across geographic areas and industry clusters. The state added more than 40,000 jobs between May and June, which put the year-over-year change at 2.9% versus a national gain of 1.7%. This was the 52nd consecutive month that the state has outperformed the nation.

Along with the rest of the country, California�s unemployment rate edged higher in June. An increase in the number of people entering or re-entering the workforce accounted for much of the rise from 5.2% in May to 5.4% in June. The unemployment rate remains well below last year�s June level of 6.2%.

The count of the state�s 29 metropolitan areas that have fully recovered from their recession job lows remains at 25. The only four metropolitan statistical areas (MSAs) that have not recovered are Hanford-Corcoran, Redding, Oxnard-Ventura-Thousand Oaks, and Yuba City. The Oxnard-Ventura-Thousand Oaks area appears likely to fully recover by the end of this year.

Merced joined the eight other California areas that have achieved increases of 6% or more relative to their prior peak levels of employment. Madera moved up to the group starting with growth rates of 3%. (See Figure 1.)

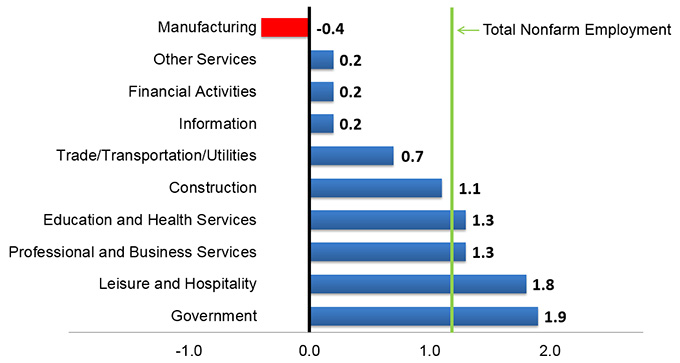

California scored larger year-over-year percent changes in jobs than the nation in almost all sectors in June. (See Figure 2.) The state underperformed only in manufacturing, where both California and the nation saw payroll reductions relative to a year ago. However, manufacturing accounts for only 8% of the state�s total nonfarm employment and factory jobs expanded significantly in the latest month.

Figure 2: California Outpaces U.S. Job Growth

Difference in year-over-year percent change, June 2016

Source: FBEI, EDD

See raw data: Employment numbers by region.

Lynn Reaser is chair of the treasurer’s Council of Economic Advisors and chief economist at the Fermanian Business and Economic Institute for Point Loma Nazarene University. The opinions in this article are presented in the spirit of spurring discussion and reflect those of the author and not necessarily the treasurer, his office or the State of California.