August 2020 Articles

Newsletter Downloads

- August 2020

HTML version, PDF version - July 2020

HTML version, PDF version - June 2020

HTML version, PDF version - May 2020

HTML version, PDF version - April 2020

HTML version, PDF version - March 2020

HTML version, PDF version - February 2020

HTML version, PDF version - January 2020

HTML version, PDF version - Year-End Highlights 2019

HTML version, PDF version

ABCs of the BCAs

August 2020

California Hub for Energy Efficiency Financing (CHEEF)

The Hub Helps Homeowners and Businesses Afford Energy Efficiency Upgrades

These dog days of August are a reminder that California summers can take a heavy toll on home and work cooling costs, not to mention the state’s power grid, as people struggle to cope with the heat. Because of the pandemic we are spending even more time at home and many of us are seeing our electric bills spike higher as a result. In just a few months, most of us will be turning on the furnace to stave off the winter chill, bringing on another increase in energy use, another round of high bills.

According to the California Public Utilities Commission (CPUC), electricity usage across California rises 14 percent on average each summer and as much as 36 percent in the Central Valley. Natural gas use spikes 41 percent each winter. Seasonal bumps in energy use and expenses, and the attendant rise in greenhouse gas emissions, do not have to be so dramatic. Energy use across the state could be cut by as much as 18 percent if California’s 13 million buildings were more energy efficient.

Sammie Allen, Sr. of Ridgecrest used REEL to install energy efficient air conditioning equipment and obtained an APR of 5.50 percent on his $12,000 loan. His payments are just $250 a month.

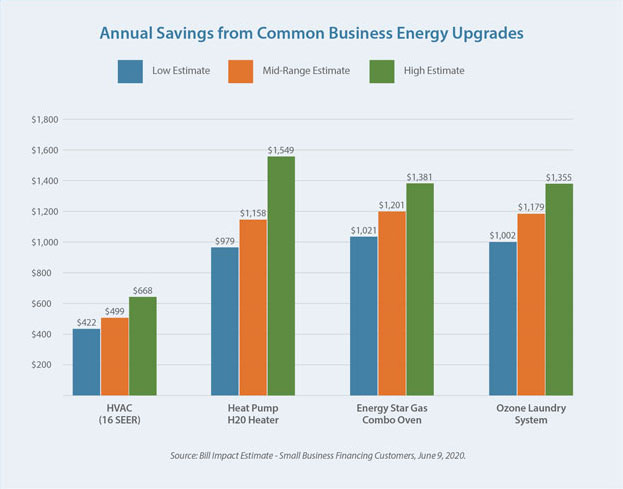

How is cost-saving efficiency achieved in houses, apartments and commercial buildings? More high-efficiency HVACs, lighting and water heaters, for starters. More insulation, cool roofs that reflect sunlight and windows that keep out drafts. More Energy Star appliances and efficient technologies like heat pumps and variable frequency drives. These energy efficiency measures can save a home or business thousands of dollars over time. The challenge for many businesses and homeowners is how to fit such long-term investments into a budget.

Enter the State Treasurer’s California Hub for Energy Efficiency Financing (CHEEF). The Hub’s financing programs for single-family residential, small business and affordable multifamily housing make it easy for Californians of all income levels to invest in energy efficiency improvements that can reduce energy use, save money and increase comfort – all while helping the Golden State reach its climate goals.

Housed in the California Alternative Energy and Advanced Transportation Financing Authority (CAEATFA) within the State Treasurer’s Office, the Hub works to increase the availability of more affordable financing for energy efficiency improvements. Through its online energy efficiency marketplace at GoGreenFinancing.com, Californians can research which energy efficiency measures qualify for financing, find a contractor to perform the installation, and locate a lender with attractive rates and terms. The Hub’s programs are available to any resident or business who receives an energy bill from an investor-owned utility (IOU): PG&E, SCE, SDG&E and/or SoCal Gas.

Financing through the State Treasurer’s Office can mean the difference between being able to afford an emergency replacement and doing without. Even if equipment is functioning, inefficiencies are far more noticeable when all activities are suddenly centered in the home, as we have seen with the shift to teleworking and online distance learning under COVID-19 stay-at-home orders.

“Right now, when people are juggling so many challenges – from changes to working hours to homeschooling kids – the last thing anyone needs is a broken air conditioner or an unaffordable energy bill,” says Treasurer Fiona Ma. “Our programs help Californians undertake the energy efficiency improvements that can make their homes and businesses more comfortable and lower their energy costs. That can be a big help at a time like this.”

The Flores family used REEL to install a tankless water heater, high-efficiency furnace and smart thermostat in their El Cajon home. They also put a heat pump in a rental unit and took advantage of REEL’s non-energy financing option to install a water filtration/softener system. Monthly payments on their $15,900 REEL loan are just $146.76.

Improving Access to Financing

Each of the Hub’s three financing programs serves a unique sector. The Residential Energy Efficiency Loan (REEL) Program finances energy retrofits of up to $50,000 for homeowners and renters of single-family dwellings. The Small Business Energy Efficiency Financing (SBF) Program offers financing of up to $5 million for small businesses and nonprofits. The Affordable Multifamily Energy Efficiency Financing (AMF) Program targets deed-restricted multifamily housing for low- to moderate-income Californians. Each program has its own features and requirements, but they share a common solution to increasing access to financing. It is known as a credit enhancement.

The California Public Utilities Commission has authorized the use of IOU ratepayer program funds to pay for the Hub’s administration as well as the credit enhancement.

Provided to participating private lenders, the credit enhancement helps mitigate the risk of customer default so lenders can offer attractive rates and terms to a broader range of customers, including those who are credit-challenged. The credit enhancement operates as what is known as a ‘loss reserve,’ which functions a little like an insurance policy for lenders. For every energy efficiency loan or financing agreement enrolled through the Hub, CAEATFA moves a percentage of the loan’s value into the loss reserve. If a borrower defaults, the lender can recover as much as 90 percent of the financed amount from the loss reserve. In return, lenders extend or improve credit terms for energy efficiency projects.

On average, REEL customers see interest rate reductions of over five percentage points (500 basis points) by financing through REEL in comparison to other personal, unsecured loans. As of July 2020, REEL interest rates ranged from 3.48 percent to 8.12 percent, compared with up to 20.8 percent for non-REEL loans. Customers are also able to extend loan terms out to 10- to 15-years, making monthly payments much more affordable than the typical five-year unsecured personal loan that is available on the market.

Fostering Energy Equity

REEL allows customers who otherwise would not have access to attractive and affordable financing to make energy upgrades to their homes. In addition to offering better rates and terms, REEL lenders finance improvements for tenants and borrowers who have lower credit scores. Because of the credit enhancement offered through REEL, traditionally underserved borrowers can enjoy the same energy savings and comfort as other California residents. Nearly one-third (28 percent) of REEL borrowers have a FICO score of 700 or under, and 52 percent of upgraded properties are located in low- to moderate-income census tracts.

Breathing Cleaner Air During Fire Season

Indoor air quality and energy efficiency have more in common than you might think. During bad air events like the 2018 wildfire season, pollutants can make their way into a home or place of business through gaps around windows, doors and ducts. Replacing windows and sealing those gaps through weatherization (also called air sealing) not only improves the quality of the air inside a building and the health of the occupants, it improved energy efficiency. In places like California’s Central Valley, where summer brings hot temperatures and higher levels of ozone and particulates, that’s a true win-win. The Hub’s programs support window replacements, air sealing, Energy Star air purifiers and HVACs with robust intake filter systems. Visit GoGreenFinancing.com to learn more.

The AMF Program allows for the financing of energy retrofits not just in common areas of apartment buildings, like hallways and laundry rooms, but inside units as well (think air conditioners, refrigerators and stoves). This makes more energy savings possible while sharing the benefits of the upgrades directly with low- and moderate-income Californians who rent rather than own a home.

Finance companies working with the Small Business Energy Efficiency Financing program find the State Treasurer’s credit enhancement program allows them to finance energy efficiency projects for businesses that may lack an extensive credit history, including newer businesses and those in the cannabis industry.

The State Treasurer’s energy efficiency financing programs make use of financing instruments that can leverage private capital to enhance the financial wellbeing of households, businesses, the environment and the overall economy of California.

The savings to families are indicated in the photo captions.

Contact Us! |

|

|

If you are a homeowner, renter, small business owner or affordable multifamily property owner interested in making energy efficiency upgrades, visit GoGreenFinancing.com to learn what projects qualify and to find a participating contractor and financing provider. |

|

If you work with a local or regional government and want to let your constituents know about the Hub’s programs, visit GoGreenFinancing.com/partners for links to pages with downloadable marketing materials, or email traci.hukill@treasurer.ca.gov. |

|

If you are a lender or finance company interested in partnering with the Hub, visit GoGreenFinancing.com/partners to access program details or email kaylee.damico@treasurer.ca.gov. |

|

If you are a contractor or energy professional interested in partnering with the Hub, visit GoGreenFinancing.com/partners to view program details or email gogreen@frontierenergy.com. |

The chart below shows the range of possible savings for businesses.

Note: Each month we will be sharing information on one of our BCAs and explain how the programs behind the acronym are enhancing the lives of Californians all across the state -- and how you, your family, or your business can share in, and contribute to, California’s prosperity.