Vol. 1, No. 2, Published June 8, 2015

California Job Tracker: 20 Metro Areas Recover Lost Jobs

By Lynn Reaser

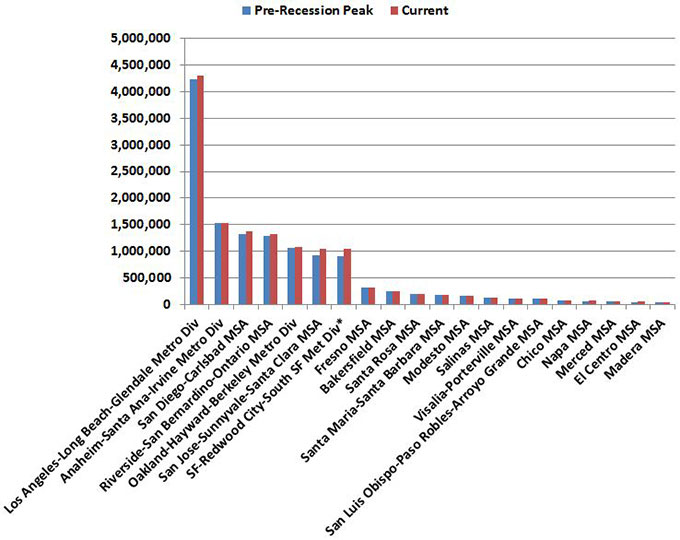

Employment numbers show that 20 of the state’s 28 major metropolitan areas have recovered jobs lost during the Recession.

In February 2014, California's job picture recovered to the pre-Recession peak seen in July 2007. Eight more metro areas joined in the recovery trend during 2014.

The large Santa Ana-Anaheim-Irvine metropolitan division (Orange County) was the latest region to catch up with its prior high in March of this year.

The 20 areas that have fully recovered their pre-Recession highs account for 84 percent of California�s current nonfarm payrolls. The Santa Cruz-Watsonville metropolitan statistical area (MSA) was briefly in the �recovery club� in March, but dropped out with a job decline in April.

The 20 metropolitan areas include a diverse group. San Francisco, San Jose and San Diego represent the impact of the surge in technology. The membership of Santa Barbara and San Luis Obispo demonstrates the rebound in prime coastal locations. The recovery of Los Angeles County and the Inland Empire (Riverside-San Bernardino) shows the diversity of the recovery among various industries, while Orange County�s rebound underscores the comeback in housing and real estate.

Despite the ongoing constraints of the drought, some of the state�s key agricultural areas have also recovered. These include El Centro, Fresno, Merced, Modesto, Salinas, Napa and Bakersfield. Bakersfield (Kern County) has also been boosted by the surge in oil exploration and development, although the precipitous drop in oil prices is already starting to weigh on the area�s job performance.

The dates of the pre-Recession peaks varied across the 2006-08 timeframe. Collectively, the 20 metropolitan areas have now added 488,000 jobs relative to their prior employment highs. The San Francisco-Redwood City-South San Francisco area has led with a job gain of about 132,000. San Jose has followed with a net growth of 124,000 positions.

Certain parts of the state still have not caught up with their pre-Recession highs. The Sacramento metropolitan statistical area (MSA) is still off by about 14,000 jobs from its prior peak. It will take about eight months for that region to regain its prior high assuming job growth equal to the average of the past 12 months. Other lagging areas include the Oxnard-Thousand Oaks-Ventura MSA (Ventura County), Yuba City, Vallejo, Stockton, Hanford, Redding and Santa Cruz-Watsonville.

It should be noted that just catching up to the pre-Recession peaks is by no means sufficient as most areas have experienced further gains in their populations over the past several years and therefore need even more job gains. Nevertheless, these recovery benchmarks are important to California and illustrate the diversification of its upswing.

Figure 21: Regions Where Job Recovery Has Met Pre-Recession Peak

(Nonfarm Employment, Seasonally Adjusted)

*Data for the San Francisco-Redwood City-South San Francisco Met Div is not seasonally adjusted.

Sources: U.S. Bureau of Labor Statistics, California Employment Development Department, Fermanian Business and Economic Institute

See raw data: Employment numbers by region.

Lynn Reaser is chief of the Treasurer’s Council of Economic Advisors and chief economist at the Fermanian Business and Economic Institute for Point Loma Nazarene University. The opinions in this article are presented in the spirit of spurring discussion and reflect those of the author and not necessarily the Treasurer, his office or the State of California.