A Tax Tip

February 2020

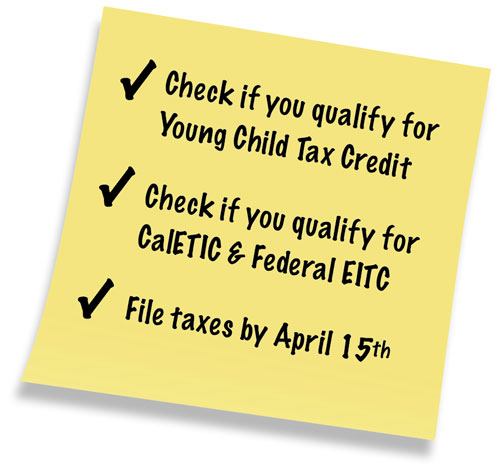

Once again, tax filing season is upon us. Which means that now is a good time to look into qualifying for federal and state earned income tax credits that can put cash back in your pocket.

The California Earned Income Tax Credit (CalEITC) is a cashback tax credit designed to benefit low- and middle-income families. According to the website CalEITC4Me.org, a public-private campaign that encourages families to file, last year more than 2 million people filed for the credit and received a total of $395 million.

You qualify for the CalEITC if you are 18 or older, have a qualifying dependent, and you made less than $30,000 in 2019. The amount you get back depends on your income and number of qualifying dependents. If you earned the maximum of $30,000 and claimed only yourself, for example, the CalEITC works out to be $240. With three or more dependents, the amount increases to $2,982. To explore how much you could get back try using the free CalEITC4Me calculator.

This year, your family may also be eligible for the Young Child Tax Credit (YCTC). An estimated 400,000 California families with at least one child younger than age 6 as of Dec. 31, 2019 will qualify for the credit, worth an additional $1,000.

Don’t forget to also visit the IRS website to find out if you qualify for the federal EITC. (If you qualify for the California tax credit, it is likely you also qualify for the federal credit.)

Lastly, if you find out that you are eligible for tax credits but did not file for them in recent years, you may still be able to file amended claims for those credits going back three tax years.

What’s it worth to you? Well, between the CalEITC, federal EITC, and the Young Child Tax Credit a family could receive as much as $8,053 when filing their tax returns, according to CalEITC4Me.org.

Need help filing your returns?

If you make less than $56,000 annually or you are over 60 years old try these free programs:

Volunteer Income Tax Assistance (VITA)

Tax Counseling for the Elderly (TCE)

February 2020 Articles

Newsletter Downloads

- February 2020

HTML version, PDF version - January 2020

HTML version, PDF version - Year-End Highlights 2019

HTML version, PDF version - December 2019

HTML version, PDF version - November 2019

HTML version, PDF version - October 2019

HTML version, PDF version - September 2019

HTML version, PDF version - August 2019

HTML version, PDF version - July 2019

HTML version, PDF version - Half-Year Highlights: Jan - Jun 2019

HTML version, PDF version - May 2019

HTML version, PDF version - April 2019

HTML version, PDF version - March 2019

HTML version, PDF version - February 2019

HTML version, PDF version